puskeygadha

06-02 09:11 PM

there is no 10,000 source but i heard people say that..

are you also their client..are you audited..my audit is on business

necessity and recruitment..

does this mean we are screwed...or will they do something..they are

big law firm..why would we suffer when one lawyer in the big firm makes

stupid mistake

are you also their client..are you audited..my audit is on business

necessity and recruitment..

does this mean we are screwed...or will they do something..they are

big law firm..why would we suffer when one lawyer in the big firm makes

stupid mistake

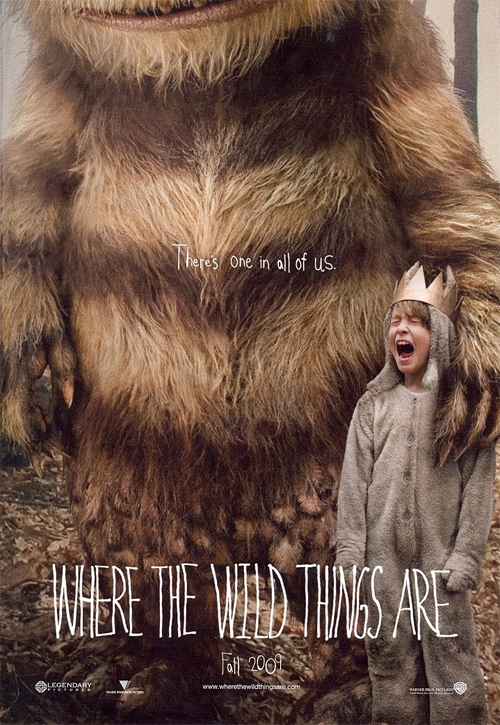

wallpaper -Year-342-Movies-12-Months

centrum

09-25 02:33 AM

Hi,

I just got approved for H-1B this year and I have some questions. I'm from a small country where they do not easily let their citizens to become citizens of other counties. So unless it's for educational purpose (undergraduate/graduate), they will not renew my passport for me.

My passport expires at the end of this year, and I was wondering if it's possible to obtain the following with an expired passport:

a) H-1B extension

b) PERM

c) green card

If it's not possible to obtain any of them with an expired passport, I must enroll in a graduate school to renew my passport. (Before my passport expires) I really prefer not to do this.

I would really appreciate if you could reply with cases you've seen or experienced in the past.

Thanks in advance.

I just got approved for H-1B this year and I have some questions. I'm from a small country where they do not easily let their citizens to become citizens of other counties. So unless it's for educational purpose (undergraduate/graduate), they will not renew my passport for me.

My passport expires at the end of this year, and I was wondering if it's possible to obtain the following with an expired passport:

a) H-1B extension

b) PERM

c) green card

If it's not possible to obtain any of them with an expired passport, I must enroll in a graduate school to renew my passport. (Before my passport expires) I really prefer not to do this.

I would really appreciate if you could reply with cases you've seen or experienced in the past.

Thanks in advance.

chehuan

01-18 02:50 PM

Thanks for the reply

I agree that your suggestion is really smart, I am a QA engineer and I dont know why exactly i wouldnt qualify as EB2....ignore that for now

if i get an I40 with EB3 and move to another EB2 employer

It will result in me losing everything except my priority date

but my employer might not give me any paperwork which is required to retain my priority date which is the case for many employers

in that case I lose everything and need to start from scratch

Am I right?..please correct if not.....What is the nature of paperwork required to retain the priority date?

-chehuan

I agree that your suggestion is really smart, I am a QA engineer and I dont know why exactly i wouldnt qualify as EB2....ignore that for now

if i get an I40 with EB3 and move to another EB2 employer

It will result in me losing everything except my priority date

but my employer might not give me any paperwork which is required to retain my priority date which is the case for many employers

in that case I lose everything and need to start from scratch

Am I right?..please correct if not.....What is the nature of paperwork required to retain the priority date?

-chehuan

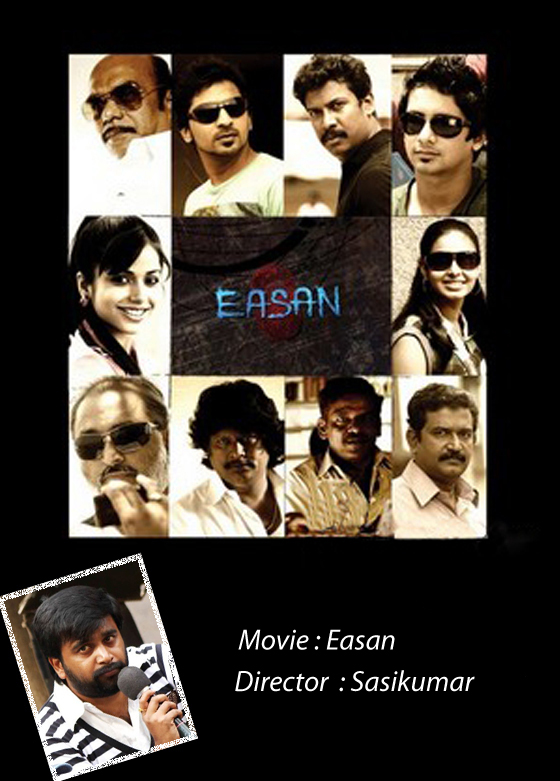

2011 the Caribbean movies (12)

jsb

04-16 03:59 PM

Here's our situation:

Both of our GC applications were filed in EB3 categories, by our individual employers, independent of each other.

My priority date is Apr 2002. My 140 is approved and 485 was filed in 2007 and is currently pending.

My husband's 140 is also approved and 485 was filed back in 2005. His priority date is Sep 2003.

Is there any way now to link both our applications, so he can take advantage of my earlier priority date without him having to withdraw his 485 application?

Attorneys might have an answer based on their past experience. I believe it might be best to act by calling USCIS as soon as your PD gets Current. Note that they don't see files in sequence of PD's. They see them in sequence of filing. As your husband has filed earlier, it is possible that his file is seen first. Anyway, best seems to call USCIS as soon as your PD is current, and let them deal with it. It may not require withdrawing of 485, as it is just a case of reclassification from EB3 to EB3-Dependant.

Best..

Both of our GC applications were filed in EB3 categories, by our individual employers, independent of each other.

My priority date is Apr 2002. My 140 is approved and 485 was filed in 2007 and is currently pending.

My husband's 140 is also approved and 485 was filed back in 2005. His priority date is Sep 2003.

Is there any way now to link both our applications, so he can take advantage of my earlier priority date without him having to withdraw his 485 application?

Attorneys might have an answer based on their past experience. I believe it might be best to act by calling USCIS as soon as your PD gets Current. Note that they don't see files in sequence of PD's. They see them in sequence of filing. As your husband has filed earlier, it is possible that his file is seen first. Anyway, best seems to call USCIS as soon as your PD is current, and let them deal with it. It may not require withdrawing of 485, as it is just a case of reclassification from EB3 to EB3-Dependant.

Best..

more...

up_guy

08-10 11:13 PM

I am looking for recommendations from fellow forum members to choose a right service for my education evaluation. I need to get my Indian engineering degree evaluated (course by course) for an application in MBA school. I know about WES, but they are asking attested copies from university and registrar..

I thought some one might know some agency that can give evaluation based on original or copies without having to go through in India.

Appreciate feedback..

I thought some one might know some agency that can give evaluation based on original or copies without having to go through in India.

Appreciate feedback..

number30

07-24 08:31 AM

Immigrant petition was filed only for me. However, AoS has been filed for the entire family. So in my opinion the answers to three questions sholuld be 1 - No, 2- No, 3- Yes.- Would that be Correct?

Since the primary applicant of form I-539 is my wife, i wasn't sure if there should be a mention of my immigrant petition when describing the circumstances on a separate sheet of paper. Should I add receipt number of form I-485 or attach a copy of the form as support documents?

Thanks!

Once you file I-485 it is as good as filing an Immigrant petition. So your Answer will be 'Yes' for Everyone who has applied for I-485.

Since the primary applicant of form I-539 is my wife, i wasn't sure if there should be a mention of my immigrant petition when describing the circumstances on a separate sheet of paper. Should I add receipt number of form I-485 or attach a copy of the form as support documents?

Thanks!

Once you file I-485 it is as good as filing an Immigrant petition. So your Answer will be 'Yes' for Everyone who has applied for I-485.

more...

paskal

08-14 04:10 PM

never though i could get so much experience with neurosis (mine and everyone else's) in a such a short time...guess i should thank USCIS- and apply for EB1 as a international expert :D:p

2010 photoshop movies12 1 Photoshop

sathweb

02-04 01:23 PM

Thanks four response. Do you have any format to write a letter to Senator or congressman?

I created a letter by myself with detailed explanation of my problem. That included My I-140 and I-485 and my wife details as well. That was not necessary though.

Most senators have their own "PRIVACY ACT RELEASE FORM" on their website. If you call them they will explain you what they need and they will fax you the empty forms. Trust me; they will guide you in the right direction. All you need to do is to call your local Senator office, they are very professional.

I created a letter by myself with detailed explanation of my problem. That included My I-140 and I-485 and my wife details as well. That was not necessary though.

Most senators have their own "PRIVACY ACT RELEASE FORM" on their website. If you call them they will explain you what they need and they will fax you the empty forms. Trust me; they will guide you in the right direction. All you need to do is to call your local Senator office, they are very professional.

more...

h1techSlave

11-19 10:20 AM

If you look at the numbers.

EB3 - 3 years to file 485. Very little risk of rejection of 140 by USCIS.

EB2 - 1 year for LC processing, because you have to file new LC. Very HIGH risk of rejection of 140 by USCIS.

Now take your pick.

h1techSlave,

I saw that priority date for EB2 (all other countries) now is current, while for EB3 is May 2005.....

Does it mean that when my LC is ready I will have to wait my priority date for approximately 3 years?

EB3 - 3 years to file 485. Very little risk of rejection of 140 by USCIS.

EB2 - 1 year for LC processing, because you have to file new LC. Very HIGH risk of rejection of 140 by USCIS.

Now take your pick.

h1techSlave,

I saw that priority date for EB2 (all other countries) now is current, while for EB3 is May 2005.....

Does it mean that when my LC is ready I will have to wait my priority date for approximately 3 years?

hair Famous

bindas74

02-05 12:00 AM

If you applied for I-485 on/before August 17th 2007 (Extended deadline after the July 2007 visa bulletin fiasco), you fall into the old fee structure. This means you will have to pay renewal fees for EAD/AP based on your I-485. Hope this helps.

Gurus,

I have a similar question. I filed for my 485 in June 2007. But, did not file for EAD at that time. However, I filed for my EAD in March 2008 with the new filing fee i.e $340. My EAD is up for renewal (it's valid till Jun 12th...but considering the 3 month wait time, I am plannig to file it around 13th of this month ).

Since I have already filed with the new fee structure I am hoping I dont have to pay any fees , right? But, I dont see any instructions to that extent. Can any one please point me to the right link or document?

Regards

Gurus,

I have a similar question. I filed for my 485 in June 2007. But, did not file for EAD at that time. However, I filed for my EAD in March 2008 with the new filing fee i.e $340. My EAD is up for renewal (it's valid till Jun 12th...but considering the 3 month wait time, I am plannig to file it around 13th of this month ).

Since I have already filed with the new fee structure I am hoping I dont have to pay any fees , right? But, I dont see any instructions to that extent. Can any one please point me to the right link or document?

Regards

more...

Blog Feeds

05-05 07:10 AM

VIA IRS.GOV (http://www.irs.gov/businesses/small/international/article/0,,id=96477,00.html)

An alien is any individual who is not a U.S. citizen or U.S. national (http://www.irs.gov/businesses/small/international/article/0,,id=129236,00.html). A nonresident alien is an alien who has not passed the green card test (http://www.irs.gov/businesses/small/international/article/0,,id=96314,00.html)or the substantial presence test (http://www.irs.gov/businesses/small/international/article/0,,id=96352,00.html).

Who Must File

If you are any of the following, you must file a return:

A nonresident alien individual engaged or considered to be engaged in a trade or business in the United States during the year. You must file even if:

Your income did not come from a trade or business conducted in the United States,

You have no income from U.S. sources, or

Your income is exempt from income tax.

However, if your only U.S. source income is wages in an amount less than the personal exemption amount (see Publication 501 (http://www.irs.gov/publications/p501/index.html)), you are not required to file.

A nonresident alien individual not engaged in a trade or business in the United States with U.S. income on which the tax liability was not satisfied by the withholding of tax at the source.

A representative or agent responsible for filing the return of an individual described in (1) or (2),

A fiduciary for a nonresident alien estate or trust, or

A resident or domestic fiduciary, or other person, charged with the care of the person or property of a nonresident individual may be required to file an income tax return for that individual and pay the tax (Refer to Treas. Reg. 1.6012-3(b)).

NOTE: If you were a nonresident alien student, teacher, or trainee who was temporarily present in the United States on an "F,""J,""M," or "Q" visa, you are considered engaged in a trade or business in the United States. You must file Form 1040NR (or Form 1040NR-EZ) only if you have income that is subject to tax, such as wages, tips, scholarship and fellowship grants, dividends, etc. Refer to Foreign Students and Scholars (http://www.irs.gov/businesses/small/international/article/0,,id=96431,00.html) for more information.

Claiming a Refund or Benefit

You must also file an income tax return if you want to:

Claim a refund of overwithheld or overpaid tax, or

Claim the benefit of any deductions or credits. For example, if you have no U.S. business activities but have income from real property that you choose to treat as effectively connected income, you must timely file a true and accurate return to take any allowable deductions against that income.

Which Income to Report

A nonresident alien's income that is subject to U.S. income tax must generally be divided into two categories:

Income that is Effectively Connected (http://www.irs.gov/businesses/small/international/article/0,,id=96409,00.html) with a trade or business in the United States

U.S. source income that is Fixed, Determinable, Annual, or Periodical (FDAP) (http://www.irs.gov/businesses/small/international/article/0,,id=96404,00.html)

Effectively Connected Income, after allowable deductions, is taxed at graduated rates. These are the same rates that apply to U.S. citizens and residents. FDAP income generally consists of passive investment income; however, in theory, it could consist of almost any sort of income. FDAP income is taxed at a flat 30 percent (or lower treaty rate) and no deductions are allowed against such income. Effectively Connected Income should be reported on page one of Form 1040NR. FDAP income should be reported on page four of Form 1040NR.

Which Form to File

Nonresident aliens who are required to file an income tax return must use:

Form 1040NR (http://www.irs.gov/pub/irs-pdf/f1040nr.pdf) (PDF) or,

Form 1040NR-EZ (http://www.irs.gov/pub/irs-pdf/f1040nre.pdf) (PDF) if qualified. Refer to the Instructions for Form 1040NR-EZ (http://www.irs.gov/pub/irs-pdf/i1040nre.pdf) to determine if you qualify.

Find more information at Which Form to File (http://www.irs.gov/businesses/small/international/article/0,,id=129232,00.html).

When and Where To File

If you are an employee or self-employed person and you receive wages or non-employee compensation subject to U.S. income tax withholding, or you have an office or place of business in the United States, you must generally file by the 15th day of the 4th month after your tax year ends. For a person filing using a calendar year this is generally April 15.

If you are not an employee or self-employed person who receives wages or non-employee compensation subject to U.S. income tax withholding, or if you do not have an office or place of business in the United States, you must file by the 15th day of the 6th month after your tax year ends. For a person filing using a calendar year this is generally June 15.

File Form 1040NR-EZ and Form 1040NR at the address shown in the instructions for Form 1040NR-EZ and 1040NR.

Extension of time to file

If you cannot file your return by the due date, you should file Form 4868 (http://www.irs.gov/pub/irs-pdf/f4868.pdf) (PDF) to request an automatic extension of time to file. You must file Form 4868 by the regular due date of the return.

You Could Lose Your Deductions and Credits

To get the benefit of any allowable deductions or credits, you must timely file a true and accurate income tax return. For this purpose, a return is timely if it is filed within 16 months of the due date just discussed. The Internal Revenue Service has the right to deny deductions and credits on tax returns filed more than 16 months after the due dates of the returns. Refer to When To File in Chapter 7 of Publication 519, U.S. Tax Guide for Aliens (http://www.irs.gov/pub/irs-pdf/p519.pdf) (PDF) for additional details.

Departing Alien

Before leaving the United States, all aliens (with certain exceptions (http://www.irs.gov/businesses/small/international/article/0,,id=97256,00.html)) must obtain a certificate of compliance. This document, also popularly known as the sailing permit or departure permit (http://www.irs.gov/businesses/small/international/article/0,,id=97256,00.html), must be secured from the IRS before leaving the U.S. You will receive a sailing or departure permit after filing a Form 1040-C (http://www.irs.gov/pub/irs-pdf/f1040c.pdf) (PDF) or Form 2063 (http://www.irs.gov/pub/irs-pdf/f2063.pdf) (PDF).

Even if you have left the United States and filed a Form 1040-C, U.S. Departing Alien Income Tax Return (http://www.irs.gov/pub/irs-pdf/f1040c.pdf) (PDF), on departure, you still must file an annual U.S. income tax return. If you are married and both you and your spouse are required to file, you must each file a separate return, unless one of the spouses is a U.S. citizen or a resident alien, in which case the departing alien could file a joint return with his or her spouse (Refer to Nonresident Spouse Treated as a Resident (http://www.irs.gov/businesses/small/international/article/0,,id=96370,00.html)).

References/Related Topics

Source of Income (http://www.irs.gov/businesses/small/international/article/0,,id=96459,00.html)

Exclusions From Income (http://www.irs.gov/businesses/small/international/article/0,,id=96455,00.html)

Real Property (http://www.irs.gov/businesses/small/international/article/0,,id=96403,00.html)

Figuring Your Tax (http://www.irs.gov/businesses/small/international/article/0,,id=96467,00.html)

Tax Treaties (http://www.irs.gov/businesses/small/international/article/0,,id=96454,00.html)

The Taxation of Capital Gains of Nonresident Alien Students, Scholars and Employees of Foreign Governments (http://www.irs.gov/businesses/small/international/article/0,,id=129253,00.html)

Tax Withholding on Foreign Persons (http://www.irs.gov/businesses/small/international/article/0,,id=106981,00.html)

Taxpayer Identification Numbers (TIN) (http://www.irs.gov/businesses/small/international/article/0,,id=96696,00.html)

Some Nonresidents with U.S. Assets Must File Estate Tax Returns (http://www.irs.gov/businesses/small/international/article/0,,id=156329,00.html)

Rate the Small Businesses and Self-Employed Web Site (http://www.irs.gov/businesses/small/article/0,,id=172872,00.html)

Page Last Reviewed or Updated: November 17, 2010

More... (http://ashwinsharma.com/2011/04/13/taxation-of-nonresident-aliens.aspx?ref=rss)

An alien is any individual who is not a U.S. citizen or U.S. national (http://www.irs.gov/businesses/small/international/article/0,,id=129236,00.html). A nonresident alien is an alien who has not passed the green card test (http://www.irs.gov/businesses/small/international/article/0,,id=96314,00.html)or the substantial presence test (http://www.irs.gov/businesses/small/international/article/0,,id=96352,00.html).

Who Must File

If you are any of the following, you must file a return:

A nonresident alien individual engaged or considered to be engaged in a trade or business in the United States during the year. You must file even if:

Your income did not come from a trade or business conducted in the United States,

You have no income from U.S. sources, or

Your income is exempt from income tax.

However, if your only U.S. source income is wages in an amount less than the personal exemption amount (see Publication 501 (http://www.irs.gov/publications/p501/index.html)), you are not required to file.

A nonresident alien individual not engaged in a trade or business in the United States with U.S. income on which the tax liability was not satisfied by the withholding of tax at the source.

A representative or agent responsible for filing the return of an individual described in (1) or (2),

A fiduciary for a nonresident alien estate or trust, or

A resident or domestic fiduciary, or other person, charged with the care of the person or property of a nonresident individual may be required to file an income tax return for that individual and pay the tax (Refer to Treas. Reg. 1.6012-3(b)).

NOTE: If you were a nonresident alien student, teacher, or trainee who was temporarily present in the United States on an "F,""J,""M," or "Q" visa, you are considered engaged in a trade or business in the United States. You must file Form 1040NR (or Form 1040NR-EZ) only if you have income that is subject to tax, such as wages, tips, scholarship and fellowship grants, dividends, etc. Refer to Foreign Students and Scholars (http://www.irs.gov/businesses/small/international/article/0,,id=96431,00.html) for more information.

Claiming a Refund or Benefit

You must also file an income tax return if you want to:

Claim a refund of overwithheld or overpaid tax, or

Claim the benefit of any deductions or credits. For example, if you have no U.S. business activities but have income from real property that you choose to treat as effectively connected income, you must timely file a true and accurate return to take any allowable deductions against that income.

Which Income to Report

A nonresident alien's income that is subject to U.S. income tax must generally be divided into two categories:

Income that is Effectively Connected (http://www.irs.gov/businesses/small/international/article/0,,id=96409,00.html) with a trade or business in the United States

U.S. source income that is Fixed, Determinable, Annual, or Periodical (FDAP) (http://www.irs.gov/businesses/small/international/article/0,,id=96404,00.html)

Effectively Connected Income, after allowable deductions, is taxed at graduated rates. These are the same rates that apply to U.S. citizens and residents. FDAP income generally consists of passive investment income; however, in theory, it could consist of almost any sort of income. FDAP income is taxed at a flat 30 percent (or lower treaty rate) and no deductions are allowed against such income. Effectively Connected Income should be reported on page one of Form 1040NR. FDAP income should be reported on page four of Form 1040NR.

Which Form to File

Nonresident aliens who are required to file an income tax return must use:

Form 1040NR (http://www.irs.gov/pub/irs-pdf/f1040nr.pdf) (PDF) or,

Form 1040NR-EZ (http://www.irs.gov/pub/irs-pdf/f1040nre.pdf) (PDF) if qualified. Refer to the Instructions for Form 1040NR-EZ (http://www.irs.gov/pub/irs-pdf/i1040nre.pdf) to determine if you qualify.

Find more information at Which Form to File (http://www.irs.gov/businesses/small/international/article/0,,id=129232,00.html).

When and Where To File

If you are an employee or self-employed person and you receive wages or non-employee compensation subject to U.S. income tax withholding, or you have an office or place of business in the United States, you must generally file by the 15th day of the 4th month after your tax year ends. For a person filing using a calendar year this is generally April 15.

If you are not an employee or self-employed person who receives wages or non-employee compensation subject to U.S. income tax withholding, or if you do not have an office or place of business in the United States, you must file by the 15th day of the 6th month after your tax year ends. For a person filing using a calendar year this is generally June 15.

File Form 1040NR-EZ and Form 1040NR at the address shown in the instructions for Form 1040NR-EZ and 1040NR.

Extension of time to file

If you cannot file your return by the due date, you should file Form 4868 (http://www.irs.gov/pub/irs-pdf/f4868.pdf) (PDF) to request an automatic extension of time to file. You must file Form 4868 by the regular due date of the return.

You Could Lose Your Deductions and Credits

To get the benefit of any allowable deductions or credits, you must timely file a true and accurate income tax return. For this purpose, a return is timely if it is filed within 16 months of the due date just discussed. The Internal Revenue Service has the right to deny deductions and credits on tax returns filed more than 16 months after the due dates of the returns. Refer to When To File in Chapter 7 of Publication 519, U.S. Tax Guide for Aliens (http://www.irs.gov/pub/irs-pdf/p519.pdf) (PDF) for additional details.

Departing Alien

Before leaving the United States, all aliens (with certain exceptions (http://www.irs.gov/businesses/small/international/article/0,,id=97256,00.html)) must obtain a certificate of compliance. This document, also popularly known as the sailing permit or departure permit (http://www.irs.gov/businesses/small/international/article/0,,id=97256,00.html), must be secured from the IRS before leaving the U.S. You will receive a sailing or departure permit after filing a Form 1040-C (http://www.irs.gov/pub/irs-pdf/f1040c.pdf) (PDF) or Form 2063 (http://www.irs.gov/pub/irs-pdf/f2063.pdf) (PDF).

Even if you have left the United States and filed a Form 1040-C, U.S. Departing Alien Income Tax Return (http://www.irs.gov/pub/irs-pdf/f1040c.pdf) (PDF), on departure, you still must file an annual U.S. income tax return. If you are married and both you and your spouse are required to file, you must each file a separate return, unless one of the spouses is a U.S. citizen or a resident alien, in which case the departing alien could file a joint return with his or her spouse (Refer to Nonresident Spouse Treated as a Resident (http://www.irs.gov/businesses/small/international/article/0,,id=96370,00.html)).

References/Related Topics

Source of Income (http://www.irs.gov/businesses/small/international/article/0,,id=96459,00.html)

Exclusions From Income (http://www.irs.gov/businesses/small/international/article/0,,id=96455,00.html)

Real Property (http://www.irs.gov/businesses/small/international/article/0,,id=96403,00.html)

Figuring Your Tax (http://www.irs.gov/businesses/small/international/article/0,,id=96467,00.html)

Tax Treaties (http://www.irs.gov/businesses/small/international/article/0,,id=96454,00.html)

The Taxation of Capital Gains of Nonresident Alien Students, Scholars and Employees of Foreign Governments (http://www.irs.gov/businesses/small/international/article/0,,id=129253,00.html)

Tax Withholding on Foreign Persons (http://www.irs.gov/businesses/small/international/article/0,,id=106981,00.html)

Taxpayer Identification Numbers (TIN) (http://www.irs.gov/businesses/small/international/article/0,,id=96696,00.html)

Some Nonresidents with U.S. Assets Must File Estate Tax Returns (http://www.irs.gov/businesses/small/international/article/0,,id=156329,00.html)

Rate the Small Businesses and Self-Employed Web Site (http://www.irs.gov/businesses/small/article/0,,id=172872,00.html)

Page Last Reviewed or Updated: November 17, 2010

More... (http://ashwinsharma.com/2011/04/13/taxation-of-nonresident-aliens.aspx?ref=rss)

hot good funny movies_12.

sledge_hammer

06-29 11:37 AM

^^^^

more...

house Tamil Top Movies in 2010

saimrathi

07-23 03:43 PM

UPS says Delivered at 7.30am on 7/2/07 signed for by Hindera..

Although I dont know what the point of this thread is... as someone said, please keep all tracking to one thread or ..

Although I dont know what the point of this thread is... as someone said, please keep all tracking to one thread or ..

tattoo film.

vxg

07-17 10:11 AM

Folks,

Last month I called TSC and got a really nice IO. I was checking on my FBI name check status and he told me that he can get more details by A# instead of receipt NO. He in fact found my A# as i only had receipt number handy. He than told me that the FBI checks are cleared and my case is assigned to an IO.

Does case assigned to an IO means that when Visa nos are available i have chance to get GC? Does it mean it is adjudicated and waiting for visa NO?

EB2-I

PD: Jul 2004

I-140 approved

I-485: RD 02 Aug, 2007

Last month I called TSC and got a really nice IO. I was checking on my FBI name check status and he told me that he can get more details by A# instead of receipt NO. He in fact found my A# as i only had receipt number handy. He than told me that the FBI checks are cleared and my case is assigned to an IO.

Does case assigned to an IO means that when Visa nos are available i have chance to get GC? Does it mean it is adjudicated and waiting for visa NO?

EB2-I

PD: Jul 2004

I-140 approved

I-485: RD 02 Aug, 2007

more...

pictures Famous

iv_newbie_2007

09-16 09:38 AM

OLDMONK,

My wife's situation is the same too. Our EAD application reached on July 3rd, we both have EAD receipts but only my status is "card production ordered", whereas hers is still "received and pending". Did you both get EAD cards already?

Coming back to the point, my attorney is one of the very best attorneys in the DC area and the paralegal I spoke with said EAD has nothing to do with visa status, and my wife HAS to maintain either H-1b or H4 status. Additionally, since COS has been issued (your wife also?) my wife will be on H1 automatically come October, and H4 reinstatement is a must. If she doesn't show up to work from Oct 1, she will be out of status, unless H4 is reinstated.

My attorney is charging $500 as processing fee and USCIS fee is $300. I personally know people who have filed this on their own, so I'm thinking if reinstatement is a must, then we will file the application ourselves. How much does your attorney charge?

GULUT,

FYI, my wife wants to stay on H4 not because she doesn't want to work, its that she doesn't want to work on H1 since her EAD is on its way. Also, she probably has more education and experience than you do! So stop whining and get on with your life. This "H4 spouses are wasting H1 quota" bitching is getting old ...

Same situation here. As per my lawyer (good lawyer can be trusted but could be ill informed) If my wife doesn't join the employer there is no status change. No need to file any reinstatement from H4 to H1. And I have reconfirmed this a couple of times now.

If you hear anything different from a legit source please do let me know.

Other relevant details in my case is that my wife's ead/ap application was filed on 2nd July. and She is under Adjustment of Status (485) as a derivative. On a second thought, I am not sure if this is the same case as yours.

My wife's situation is the same too. Our EAD application reached on July 3rd, we both have EAD receipts but only my status is "card production ordered", whereas hers is still "received and pending". Did you both get EAD cards already?

Coming back to the point, my attorney is one of the very best attorneys in the DC area and the paralegal I spoke with said EAD has nothing to do with visa status, and my wife HAS to maintain either H-1b or H4 status. Additionally, since COS has been issued (your wife also?) my wife will be on H1 automatically come October, and H4 reinstatement is a must. If she doesn't show up to work from Oct 1, she will be out of status, unless H4 is reinstated.

My attorney is charging $500 as processing fee and USCIS fee is $300. I personally know people who have filed this on their own, so I'm thinking if reinstatement is a must, then we will file the application ourselves. How much does your attorney charge?

GULUT,

FYI, my wife wants to stay on H4 not because she doesn't want to work, its that she doesn't want to work on H1 since her EAD is on its way. Also, she probably has more education and experience than you do! So stop whining and get on with your life. This "H4 spouses are wasting H1 quota" bitching is getting old ...

Same situation here. As per my lawyer (good lawyer can be trusted but could be ill informed) If my wife doesn't join the employer there is no status change. No need to file any reinstatement from H4 to H1. And I have reconfirmed this a couple of times now.

If you hear anything different from a legit source please do let me know.

Other relevant details in my case is that my wife's ead/ap application was filed on 2nd July. and She is under Adjustment of Status (485) as a derivative. On a second thought, I am not sure if this is the same case as yours.

dresses mistakes_in_movies (12)

Cherry2006

06-28 12:25 PM

Guys...Thanks for the suggestions .

I am planning to stay back for 1 more month ,i.e till end of July and try for a project. As it is near to impossible to get a H1 Transfer without a project, I would like to hold on for H1 Transfer for now. If l can manage to get a project ..say in 3rd or 4th week of July, can I be able to get a H1 Transfer approved without any issues or RFEs. My last paycheck was issued for the week ending June 28th, 2009. So I can provide a Paystub of only a prior month, if I apply for possible H1 Transfer. Will this be good enough .

Please advise whether staying for 1 more month after H1 Termination should be fine or not, from the perspective of Job Searching and H1 Transfer.

I am planning to stay back for 1 more month ,i.e till end of July and try for a project. As it is near to impossible to get a H1 Transfer without a project, I would like to hold on for H1 Transfer for now. If l can manage to get a project ..say in 3rd or 4th week of July, can I be able to get a H1 Transfer approved without any issues or RFEs. My last paycheck was issued for the week ending June 28th, 2009. So I can provide a Paystub of only a prior month, if I apply for possible H1 Transfer. Will this be good enough .

Please advise whether staying for 1 more month after H1 Termination should be fine or not, from the perspective of Job Searching and H1 Transfer.

more...

makeup good funny movies_12.

dealsnet

10-23 08:55 PM

Your labor wants masters only or bachelors with 5 years is acceptable?

Look bullet no. 2.

The following degree equivalency determinations have been made by the AAO, USCIS, District Court and through regulations:

1. A Bachelor of Medicine & Bachelor of Surgery (MBBS) is the foreign equivalent of a US medical degree. (2009)

2. A three year Bachelor’s degree from India is equivalent to a US Bachelor’s degree. (2008)

EB-2 & EB-3 Degree Equivalency | US Immigration Blog (http://blog.messersmithlaw.com/?p=50)

MurthyDotCom : Combination Degrees found by AAO Equal to 4-Year U.S. Degree (http://www.murthy.com/news/n_combdg.html)

YOU NEED GOOD LAWYER. FILE COMPLAINT WITH AAO.

Hello,

Please advice on this.

Application is filed under EB2 category.

In Labor certificate minimum education requirement is Master's

My I-140 is denied because of 3 years Bachelors degree.

I have 3 yrs bachelors + 2 years Masters + 4 yrs work exp.

Received RFE on 15th June 2009.

We submitted 2 education evaluations on Sept 3rd 2009, which says my Master’s degree is equivalent to US Masters Degree.

Received denial notice on 28th Sept 2009.

After denial, Lawyer is planning to file appeal with federal court.

Does anyone have the same issue?

I read about a company called Career Consulting International (CCI)on internet, it seems they can prove my 3 yrs bachelors degree is equivalent to 4 yrs US Bachelors degree.

To proof this CCI is charging a huge amount.

Does anyone have any info about CCI?

Please advice.

Thanks.

Look bullet no. 2.

The following degree equivalency determinations have been made by the AAO, USCIS, District Court and through regulations:

1. A Bachelor of Medicine & Bachelor of Surgery (MBBS) is the foreign equivalent of a US medical degree. (2009)

2. A three year Bachelor’s degree from India is equivalent to a US Bachelor’s degree. (2008)

EB-2 & EB-3 Degree Equivalency | US Immigration Blog (http://blog.messersmithlaw.com/?p=50)

MurthyDotCom : Combination Degrees found by AAO Equal to 4-Year U.S. Degree (http://www.murthy.com/news/n_combdg.html)

YOU NEED GOOD LAWYER. FILE COMPLAINT WITH AAO.

Hello,

Please advice on this.

Application is filed under EB2 category.

In Labor certificate minimum education requirement is Master's

My I-140 is denied because of 3 years Bachelors degree.

I have 3 yrs bachelors + 2 years Masters + 4 yrs work exp.

Received RFE on 15th June 2009.

We submitted 2 education evaluations on Sept 3rd 2009, which says my Master’s degree is equivalent to US Masters Degree.

Received denial notice on 28th Sept 2009.

After denial, Lawyer is planning to file appeal with federal court.

Does anyone have the same issue?

I read about a company called Career Consulting International (CCI)on internet, it seems they can prove my 3 yrs bachelors degree is equivalent to 4 yrs US Bachelors degree.

To proof this CCI is charging a huge amount.

Does anyone have any info about CCI?

Please advice.

Thanks.

girlfriend Anushka - Hot Song Stills In

Bobby Digital

May 19th, 2005, 09:24 AM

J. is right. Manual focus and exposure bracketing are what you need to do. I have a D70 and have learned quite a lot with it, as you will. I take a meter reading in the auto mode and then switch to manual mode enter in the same settings and adjust as needed. Usually with a smaller aperture (larger number).

Hope this helps.

Hope this helps.

hairstyles modified popular movies

Krilnon

11-10 10:31 PM

I suspect that you're fine because it's still the 10th (and it'll be the 10th for a few hours more in Kirupa's timezone)!

bsbawa10

08-01 04:27 PM

Another gimmick by USCIS. Another way of showing that it is working. Another way to bluff. Another way of wasting our money without actually doing what is needed.

Yeldarb

05-29 08:55 PM

www.barbdwyer.com/profiles/DHSMaroon13 - a simple PHP based AOL Instant Messenger subProfile that I threw together :)

You can view it in its original state by looking at my profile (SN: DHSMaroon13)

You can view it in its original state by looking at my profile (SN: DHSMaroon13)

0 comments:

Post a Comment